The Irony of Renouncing Under Duress

The following post is one of a series about American values related to my renunciation of US citizenship in November 2015.

In my journey through the wilds of US law as it applies to overseas Americans, I’ve joined a few Facebook groups where people in this situation share information about tax law, FATCA, and individual countries’ IGA (Intergovernmental Agreement) rules, as well as news about renunciations and related lawsuits.

A fellow overseas American I know from one of these groups pointed out an irony about renunciation that I think is worth sharing with a larger audience.

Written Statement about Renunciation

When Americans renounce their citizenship, as I did, we are required to sign a form called “Statement of Understanding Concerning the Consequences and Ramifications of Relinquishment or Renunciation of U.S. Citizenship” (Form DS-4081) that includes the following:

“I am exercising my right of renunciation/relinquishment freely and voluntarily without force, compulsion or undue influence placed upon me by any person.”

The forms are sent to the US State Department after signing, where the application is approved before the person renouncing can receive a Certificate of Loss of Nationality (CLN). The CLN is necessary to do any banking and in many employment situations where being an American can mean banks and other companies refuse to do business. It may also be necessary for travel to the US, where those born in the US are required to use their US passport.

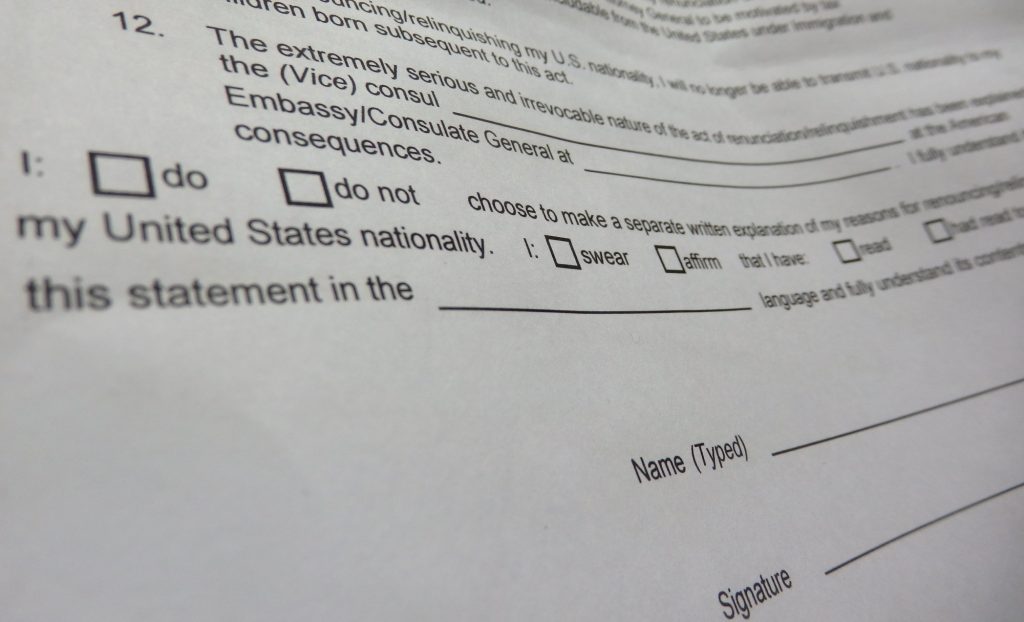

We are also allowed—but not required—to include a written statement explaining why we have renounced:

“I do / do not choose to make a separate written explanation of my reasons for renouncing/relinquishing my United States nationality.” (Form DS-4081)

It’s not clear what the purpose of this separate statement is, but I handed one in because I had a strong feeling that I couldn’t do something so irrevocable without someone—anyone—hearing why I did it, and hearing that I did it extremely reluctantly. You can read it on Medium.

Two of the employees behind the counter at the consulate read it while I waited, and one told me that he would recommend that my request be granted. He said that my statement made it clear that I was not acting under duress but had thought out the decision carefully.

The implication of this is that the State Department can also turn down an application to renounce. This leads to lots of questions: what happens if they turn it down? Is there an appeals process? And do I get my $2350 back? What if someone does not hand in a statement, like the man who renounced just before me that day? Are they more likely to get the application rejected?

Renouncing Under Duress

‘Under duress” means that you were somehow forced or pressured to renounce citizenship, and I agree that no one should be forced. However, many people who have renounced recently, or are planning to renounce, state that they have to do so: they are forced into it by circumstances.

For some, it’s a matter of being unable to find a bank to do business with because the banks don’t want the expense of complying with the new FATCA disclosure rules.

For some, renunciation is necessary because otherwise, according to their adopted country’s IGA with the US, they’ll be double-taxed on sales of property or pension payments.

For some, including me, it’s a matter of the cost of paying an accountant and dealing with a resentful non-US spouse who ends up handing his financial information over to the US government.

You could, then, interpret our reasons for renouncing as being an example of acting “under duress,” except the pressure comes from the US government itself!

In my written statement, I did indeed write that I was renouncing due to various US government actions against overseas Americans. My application for renunciation will either be rejected or approved.

Hypothetical situation number 1: rejection

- Because the State Department sees that I am acting under duress, it rejects my application to renounce citizenship.

- The fact that the US government rejects the situation as a case of duress confirms that its own policies are oppressive.

- And, if that happens, I’m remaining a US citizen under duress in that I no longer want to be a citizen.

Quite ironic, isn’t it?

Hypothetical Situation number 2: approval

- The State Department accepts my statement as valid reasoning to approve my renunciation.

- In that case, its acceptance of the validity of my grievances implies that citizen-based taxation and all of the consequences of it (FATCA, privacy-invasion, etc.) are indeed causing the increase in renunciations.

- The State Department is thus reaffirming that the FATCA regime is unjust.

Also ironic!

Of course, it’s unlikely that my application or anyone else’s will be rejected. The US is only interested in getting tax dollars from overseas Americans, not serving our needs in any way. I don’t think the government really cares if we renounce, as long as we pay up: both any taxes we may owe plus the exorbitant renunciation fee. The form I was required to sign also states:

So even after renouncing (which I’ve done already) and receiving my CLN (which I haven’t), I won’t yet be free. The IRS can still audit my returns to see if I did them right, and can still impose fines if they notice differences between my returns and the account information the banks send them under FATCA rules.

I think someone at the State Department needs to look up the meaning of “duress”!

My whole US citizenship series:

- Part 1: Giving up US citizenship?

- Part 2: Republicans, expatriates, and FATCA

- Part 3: How my citizenship hit me in the gut

- Part 4: My renunciation day

- Part 5: Thanksgiving reconsidered

- Part 6: FATCA, the Tea Party, and me

- Part 7: Individual freedom, self-reliance and renunciation

- Part 8: Equality? Competition? Not overseas!

- Part 9: The American Dream

- Part 10: The irony of renouncing under duress

- Part 11: Open letter to President Obama in response to the State of the Union Address

- Part 12: 7 Reasons NOT to renounce

- Part 13: Citizenship matters

- Part 14: Citizen of a parallel world

- Part 15: Renunciations in the news

- Part 16: Vote … as a non-citizen? Really?

- Part 17: The ridiculous story of a pilot and his taxes

- Part 18: On receiving my Certificate of Loss of Nationality

- Part 19: So you think you want to emigrate…

- Part 20: Indignation Fatigue and FATCA

- Part 21: The US election, as seen by Americans overseas

- Part 22: On receiving my California voter ballot

- Part 23: Watching America fall apart on my renunciation anniversary

I think someone at the State Department needs to look up the meaning of “duress”!

@StateDept @JohnKerry https://rachelsruminations.com/renouncing-under-duress/

#FATCA CBT

https://twitter.com/JCDoubleTaxed/status/685637159865290752

Good idea! I’ll add @statedept to the tweetthis widget!

The irony you noted here is something that no doubt occurs to most renunciants, but – for obvious reasons – most decline to comment on. Hats off to you for your courage in doing so, Rachel. And that the USG is only interested in collecting revenue is all too obvious as well. While an American who renounces his citizenship to become German now pays $2,350, a Canadian pays ca. 90 Canadian dollars to renounce and can do it by mail (as US Sen. Ted Cruz did). What’s more, a German who takes out US citizenship does this at no charge, as taking out US citizenship automatically rescinds German citizenship and no CLN is required for ex-Germans, since Germany does not tax the foreign income of German citizens. So the fee alone makes matters clear enough. I might also add that my last US passport set me back $183 and my first German ID (which is valid for traveling throughout Europe) cost me only €23. A full-fledged German passport, which I don’t really need, would have cost me ca. €63. And the exorbitant fees charged for US Consular services are probably one of the main reasons why the State Dept., unlike most branches of the USG, actually turns a profit.

To clarify what I just said about taking out US citizenship, a German does pay ca. $1,000 to the USG on becoming a US citizen, but does not have to pay any appreciable renunciation fee to the German Govt.

The State Department claims they need to charge that much for the cost of administering the applications. How much time do you suppose they actually spend checking it (and me) out?

I think that may vary from one case to another. If no heightened security check is done, IMHO it should take only a few minutes to an hour to check an average person’s US records.

Good pay for an hour’s work!

When is Nightlife program airing ?

Nightline

No idea. They interviewed me the day I renounced but other things keep happening that are more timely. Hopefully soon…I’ll let everyone know!

Yes a good point to bring up on nightline. Also, to those press who were following your story.

Is anyone from the press following it?

I think it’s all ludicrous. Why the h*ll should you have to give ANY reason to discard such an albatross? Isn’t it obvious to these people by now? Their backlog ought to be evidence enough that there’s something VERY wrong here.

They know what’s happening & they know that honest, tax-compliant people who live & work outside the US shouldn’t be getting attacked this way & they just don’t care…

It’s disturbing that nothing is being reported on this in the media.

I agree with you completely, though it is beginning to hit the media … I suspect it will be in the news again when the year-end stats come out about renunciations in 2015.

Yes, except that we all know they do NOT report them ALL. Many people at Isaac Brock have stated that their name never made the “list”.

As someone there wrote, I’d like the “shame” list to state the tax owed…so that everyone can understand & grasp what this really is about: A hope to hang honest people via “penalties” no one ever knew about.

It’s all being handled very, “hush, hush” – which is even more disturbing…

But is that intentional or just bureaucratic bumbling? I’m not sure. In any case, it would be great if it said how much tax was owed, separately from the penalties, so people could see how disproportionate it can be!

Exactly! But they won’t ever do that because it would expose the farce. Ironically, they’d likely trot-out that they can’t include that due to “privacy” laws- lol. Even as they extort/overreach other countries into divulging information which no US homelander has to provide!

And though there’s plenty of “bumbling”, I don’t see how this is still unheard of/non-reported for the past three years? That’s a lot of bumbling…We expats number in the millions & are being singled out deliberately & it’s not being reported. Imagine if any of the mainland states, with less population than we have (there are 40), being subjected to this predatory & restrictive behaviour? All Arizonians are now subject to different tax rules…Omg– there would be a suit filed the next day & the press would have reporters everywhere.

The reason we’re the scapegoats is because of the warped ideology that has infected the USA– if you’re not with us (in our borders) you’re against us (& you’re unpatriotic). That, and that by being spread out, we have no “teeth”. The only serious push-back is the case heading to the Canadian court.

There are a couple of other lawsuits going as well. The problem for me is that these big lawsuits take so long! Even if the Canadians who are suing the Canadian government win their lawsuit it won’t affect me unless the US changes FATCA rules as a result, and that will undoubtedly take even more time.

Yes, courts are slow & expensive. However, once one country backs away from FATCA, the precedent will be set. I’m sure other victim-countries are looking at the cases very closely. Fingers-crossed.

Eventually, I can see the USA becoming even more predatory. The super-wealthy (the true overseers) love their loopholes, dirty accountants, purchased politicians, & the hoarding of both wealth & power. They expect double-digit returns even when they, themselves, are the reason there are no more good-paying, manufacturing jobs left in the USA! Thank you, Ronald Reagan! Prior to his lying, cheating “trickle-down-economics”, a family could have one parent at home, pay their bills, put their kids through college, & save for retirement…then, came Reagan & his legal shift to rewarding the wealthy.

I wonder where it will all end… 🙁

Yes, I wonder too. I hope you’re right about the Canadian case setting a precedent!

Rachel – an interesting post.

The only Americans who can live outside the borders of the United States are those who are NOT in compliance with FATCA, FBAR, PFIC, Form 5471, Form 3520, … and the whole “Alphabet Soup” list of restrictions imposed on those who reside outside the United States. Those who attempt compliance, will soon learn that they have entered a “fiscal prison” which makes life impossible. To see a lengthy post on why this is true, Google: “Richardson When in Rome Live as a homelander”. It will explain why those who live as Americans abroad who are in compliance with U.S. laws will ultimately be forced to renounce their U.S. citizenship.

Most Americans abroad are of the view that they must be in tax compliance in order to renounce. Strictly speaking this is NOT true (although advisable). There is a group of people who are formally renouncing U.S. citizenship (not advisable) for the sole purpose of terminating ongoing tax liabilities.

On the question of duress, my view is:

A. Those Americans abroad who are tax compliant are forced to renounce (they must escape the “prison of life restrictions and life control”). They do a formal “renunciation”. The State Department pretends that the renunciation is voluntary when they know it is not. The description in your post underscores that the State Department is confusing “voluntary” with “rational”.

B. Those Americans abroad who are NOT tax compliant are NOT forced to renounce (they have not entered the “prison of life restrictions and life control”). Some simply choose to renounce to terminate the compounding of further problems. Others simply choose to do an informal renunciation (simply assume they will have no further contact with the USA).

For a fascinating account of why a Toronto woman who had been filing U.S. taxes for 40 years (doesn’t get more tax compliant than that) felt she was finally forced to renounce her U.S. citizenship see this post at Robert Wood’s blog:

forbes.com/sites/robertwood/2014/08/15/dear-mr-president-why-im-leaving-america/#7df150e6c814

For a long time, I was one of those in your second category who was NOT tax compliant and not forced to renounce. The problem for me was the fear: what if the IRS notices that I’m not filing? And then, once FATCA was passed, what if the bank identifies me as American? And then there were the threatened fines for omissions on the FBAR! Which angered me when I saw that I had to hand over all this information that homelanders don’t have to. I lost sleep from worry. So I got compliant but then because of the expense (not taxes, but rather accountant costs) and the privacy issue and the complete lack of representation to be able to complain about it all, I ended up renouncing, just to get out from under all the worry and anger and expense.

You write:

” I ended up renouncing, just to get out from under all the worry and anger and expense.”

and earlier you write:

“The problem for me was the fear: what if the IRS notices that I’m not filing?”

As you point out renunciations are NOT driven by taxes. (Although there is a significant group of Americans abroad who do owe U.S. taxes.) Renunciations are driven by the huge emotional cost of living as an American abroad. The culture of fear is extreme and significant. (It’s really a form of terrorism that is directed against Americans abroad by Homeland politicians and tax compliance people.)

When working with clients, I begin by getting them to see that there are both “emotional aspects” and “legal aspects”. Only when the two are separated, is it possible to work these problems through. The reality is that:

Whether the person is consumed by emotions (fear vs. anger) or whether the person is consumed by cost (either compliance or actual taxes or both), the conclusion is usually the same.

Renounce and get on with the job of living your life.

Exactly. I get emails pretty frequently from people who have just realized that they were supposed to be filing US tax forms, asking what they should do. Besides referring them to the Isaac Brock site, that’s pretty much what I tell them: either keep your head down and don’t get into the system, or get compliant and then decide whether you want to renounce or not. Some (I know quite a few personally.) are comfortable with the strategy of just trying to stay out of sight. It’s probably just a personality thing, but I couldn’t do that. It was too stressful for me.

“It’s probably just a personality thing, but I couldn’t do that. It was too stressful for me.”

Yup. those who end up renouncing are those want to be the most law abiding. What kind of a country persecutes it most law abiding citizens?

I never really thought about it that way: law-abiding. Yet not getting compliant could easily be seen as civil disobedience. The people who took part in sit-ins in the Civil Rights Movement were not being law-abiding, yet it was the right thing to do.

Well the “right thing to do” may or may not coincide with the law. In the United States of today, the law has absolutely no moral authority. It seems to me that “right” and “wrong” are moral, but not “legal” questions. After all, if morality was driven by the law, then FATCA, FBAR, etc. would be moral.

Indeed, the law should be based on ethics, not ethics on the law!

I’ll play the part of the “conspiracy-theorist”. You know, the one the establishment attacks for reporting the vile things they’ve done w/o any lawful scrutiny? And no, I generally (never) have posted as such.

I see FATCA & TPP as global partners. They are an outright grab of both money & power– out of the hands of sovereign nations & individuals, & in defiance of those nation’s own laws protecting their citizens. The world has reached it’s “saturation of dodgy politicians” and so THIS is the result. Add in the “press”, now owned by 3 “people” for better term- & these 3 are influencing the gov’t process, too.

You’d think the people involved would “feel bad”? NO. Please do a Google search of “Joanna Ashmun NPD” & get a life-saving education for free.

This, is a horrendous breach of the trust handed to the USA after the 1st world war aka: Bretton Woods. Instead of being serious of their role, the kindly Shepard, the USA has become the slaughterer.

The UN & the world’s gov’t MUST rise against this. Whatever “deal” the USA has promised you to participate in this horror, is a lie.

As I’ve said before, I tend not to think this all is a result of any kind of conspiracy, but rather a general bumbling on the part of politicians and government bureaucrats who think they’re doing the right thing, or who are just working out of self-interest. I think it’s perfectly possible to point out wrong legislation like FATCA as being an abuse of power without jumping the next step to accusing anyone of a grand conspiracy. Yes, they’ve blown it, but I still think it’s fixable. I don’t see how Narcissistic Personality Disorder, a mental illness, has anything to do with this. Are you saying the government is narcissistic? I would say more megalomaniacal, if anything.

No, I’m saying that “money is the root of all evil” & that with immense wealth comes ever increasing flexing & desire of power– and that those who manipulate the political/legal process very often exhibit most traits of NPD. Further, I find that most people have no idea what that sort of disorder in a person actually means to the rest of us where power & corruption are concerned. Inability to empathize means “anything goes”, & without remorse.

I could even agree that this was “all just a misunderstanding”– except that a) it seems to be so deliberately “non-covered” that literally NO ONE I’ve spoken to has ever heard of FATCA (& don’t believe me when I tell them), b) the “powers that be” have been made aware & nothing has changed, c) TPP allows corporations to sue countries if the environmental laws hinder their profits…I mean, really…who doesn’t understand that this is insanity & yet it’s being “fast-tracked”. Who’s this good for again?? Oh, right– it’s for OUR best interests. C’mon, now- are you quite happy with all of this? I don’t believe in coincidence when it happens like this. Everything aligning for the benefit of the very few but extremely wealthy & influential. Things that used to be illegal are simply being “re-worked” & I guarantee no “little guy” ever pushed to create all of those loopholes utilized by the 1%. So, how did they ever come to be in the first place? The whole thing stinks.

I see your point. I guess I’m just not ready to believe it’s a conspiracy. Perhaps after a few more coincidences….

This article is from 2014. There are plenty of other articles out there which lay out that the “coincidences” just keep coming…

http://www.salon.com/2014/04/19/reaganomics_killed_americas_middle_class_partner/

I’m reminded of the frog in the pot story:

“The boiling frog is an anecdote describing a frog slowly being boiled alive. The premise is that if a frog is placed in boiling water, it will jump out, but if it is placed in cold water that is slowly heated, it will not perceive the danger and will be cooked to death. The story is often used as a metaphor for the inability or unwillingness of people to react to or be aware of threats that occur gradually.”

If nothing is done soon, there will reach a time that there will be no turning back the clock. I wish I (or anyone) knew the answer. My money is on USA Sen. Sanders, but whether or not the system is already rigged to exclude the do-gooders remains to be seen.

“My money is on USA Sen. Sanders, but whether or not the system is already rigged to exclude the do-gooders remains to be seen.”

I just saw the story I figured was out there: the way to stop the “do-gooders”:

http://www.dailykos.com/story/2016/2/12/1484293/-Debbie-Wasserman-Schultz-Unleashes-Ugly-Truth-Amid-the-Bafflegab

Read the story & then see if you agree with the final paragraph:

“How is she saying anything other than: We want diversity and grassroots activists to appear to be a part of our party process. We just want to make sure they can only compete with each other and not against us insiders and our choice of candidate.”

Hi, i just discovered your great blog Rachel as I’m in the same situation as you (and many) The fear you write about it so real, and although i’m now “compliant” i go from feeling a rage to take on the system to a weeping puddle on the floor – so much so that now i feel i have to renounce, which i don’t really want to as i have close family in the US and I don’t believe in these fear-filled times that travel to the US will become any easier in the long run. So, as i sit filling out form DS 4079 and wonder at the stupidity of it – (Q16 – Have i renounced my US nationality at a US consulate etc? No, of course i haven’t YET – I have to fill in these forms and send them to get an appointment to do just that!!) I was feeling strongly about the “duress” point, which led me to you – so my Q is – would you be willing to share what you wrote on your statement? From what I’ve read it’s very important not to include any reference to “tax” as this might be seen as avoidance, but i want to make my feelings clear about the draconian measures and how difficult it has made everyday life. Incidentally, do you have your CLN yet? Thanks!

I never published my statement here on the blog because I was hoping to get it published in a print publication in the US, but no one has shown any interest. I want to try a few on-line publications before I give up and post it here. I have not received my CLN yet; it’s been 4 1/2 months… I know what you mean about the range of emotions: like you, sometimes I’m furious, and sometimes I’m heartbroken. That hasn’t changed since renouncing.

Thanks – and good luck with getting that published. Is it just me, or is it strange that no one will publish in print for in the US?The fear of speaking out!

I am also in this same situation and would love to read what you wrote. I’m also interested if you finally received your CLN. Wish me luck with my renouncement.

Yes, I received my CLN: https://rachelsruminations.com/certificate-loss-nationality/

And I ended up posting my statement on Medium: https://extranewsfeed.com/https-medium-com-rachelheller-why-i-renounced-my-us-citizenship-e1f77b1969ce#.mg0d12ty3 Thanks! And good luck with your renunciation!

Any word on the Expat Nightline project ? Cheers JD

his email everyone ”

re Nightline

geoff.martz at abc.com

I don’t think bombing him with emails is going to help. If anything, it’ll just antagonize him.

Re Rachaels Nightline program project mgr and producer geoff.martz@abc.com, roxanna.z.sherwood@abc.com

That was a long time ago. I sincerely doubt they’d consider my interview newsworthy anymore!

FYI The medium page you link to in this blog post has been hacked and readers are redirected to this page [link removed by Rachel]

Thank you for letting me know! I’ve removed the link and alerted Medium to the issue. In the meantime, I’ve replaced the link with directions to search for the article on Medium. I’ll add the link back if/when Medium fixes it.

Edit: It’s been fixed and I added the link back in.