Indignation Fatigue and FATCA

A lawsuit against FATCA, the Foreign Account Tax Compliance Act, was filed back in 2014 by Senator Rand Paul and the Republicans Overseas and, while I am certainly no fan of the senator, I support this lawsuit. It was, however, dismissed in April 2016 because the Ohio federal judge who heard the case decided that the senator and the current and former US citizens who were the plaintiffs didn’t have any standing to sue on this issue. His argument was that the plaintiffs hadn’t shown that the law harmed them or was likely to.

This question of standing seems to rest on the idea that if banks, because of the expense of complying with the FATCA rules, refuse to do business with Americans, it’s the fault of those banks. In other words, the judge did not deny that the plaintiffs were hurt, but denied it was the US government’s fault. I beg to differ.

FATCA and the Constitution

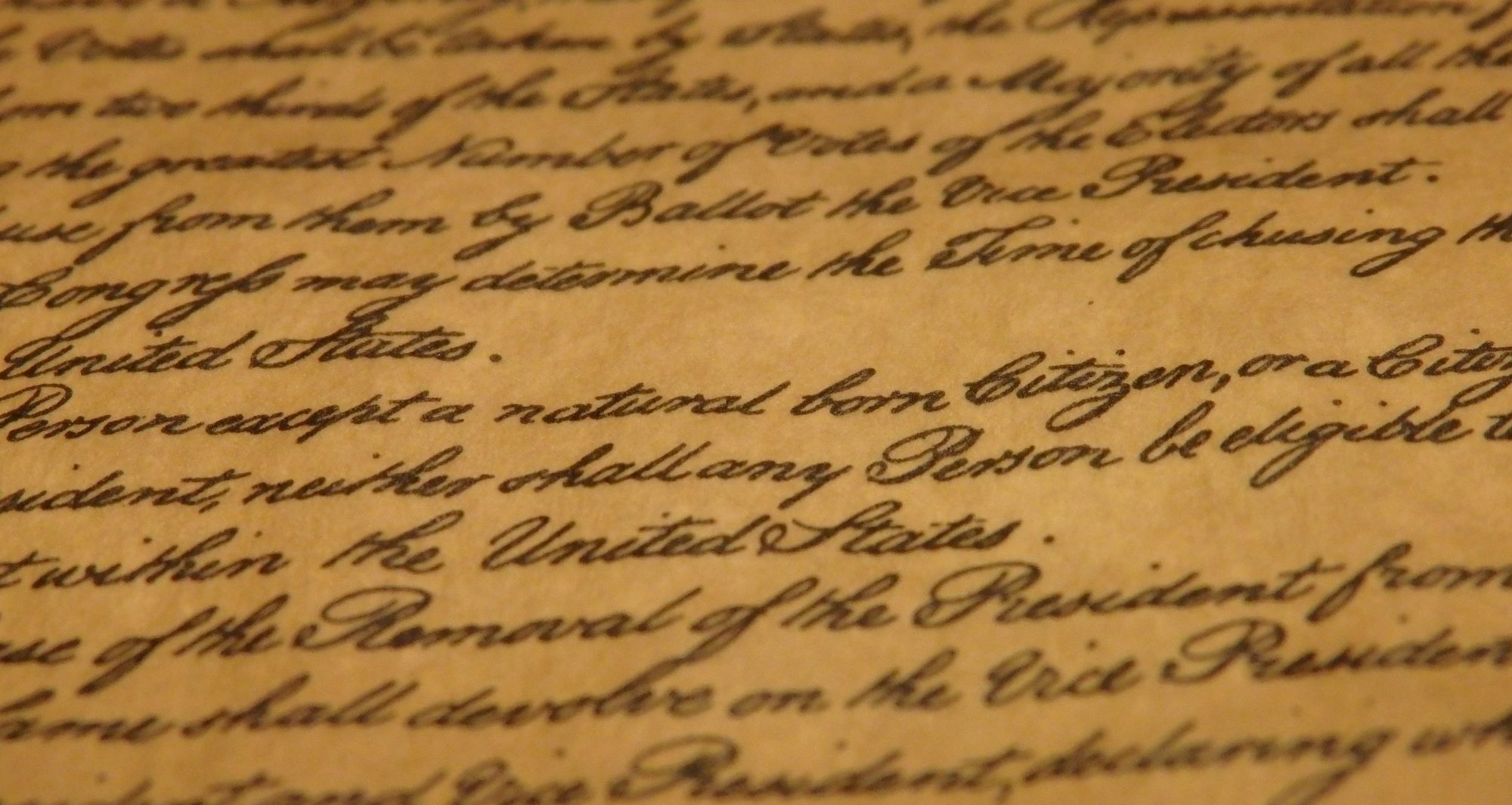

FATCA can be opposed in the US based on three main Constitutional arguments:

- Gathering so much information about citizens without a warrant violates the 4th amendment right to privacy.

- Cruel and unusual punishment, including excessive fines, is prohibited in the 8th amendment. When the fee structure means that mistakes on tax returns can trigger fees higher than a person’s assets, that’s excessive.

- The Intergovernmental Agreements (IGAs) between the US government and foreign governments are essentially treaties, and it’s the US Senate that is empowered under the Constitution to make treaties, not the Treasury Department.

So the case will be appealed or restarted, and might eventually go all the way to the Supreme Court. Lawsuits are tremendously expensive because of the legal fees, yet scraping together the money has been a problem since the beginning. So far, they’ve managed it, but it’s going to be a huge effort to raise the money to launch an appeal of the US case. And yet there are literally millions of overseas Americans who would benefit if they won.

Indignation fatigue

But that lawsuit isn’t what I want to write about. I want to write about the general reaction of Americans abroad to the US lawsuit’s dismissal and other recent events.

For the most part, the response has been underwhelming to say the least.

There has been very little outcry lately: some surprised, angry comments on Facebook groups and a few on-line essays. And it barely made the mainstream news, except in expatriate and accountancy circles.

The first-quarter 2016 reports that came out in April about how many Americans renounced their citizenship drew very little coverage outside of expat circles. The numbers are wrong, by the way—significantly underreported—yet still showed a record high of renunciations. (My name has still not made the “name and shame” list, and I renounced last November, so I should have been in this or the last one.)

When the Panama Papers were leaked, the media pointed at tax evaders, using language that presumed all of us overseas Americans were tax evaders and equating “foreign accounts” with hiding tax money. We overseas Americans were angry and defensive, since our “foreign accounts” are our local accounts. Some wrote letters to the press or posted comments online, to very little effect.

It’s not that people aren’t fighting FATCA; they are. But considering the sheer number of us (7-9 million!), I would have expected more noise. So why are we showing so little energy to fight this fight?

1. Fear

Americans overseas are afraid. If they haven’t been filing their returns, they’re afraid that the IRS will notice them. Most wouldn’t owe any money, but the cost of compliance is high (accountancy fees), especially if they don’t speak good English, and it would put them on the IRS’s radar if they filed.

Many overseas Americans have never filed taxes. They are “accidental Americans” because their parents were Americans or because they were born in the US but grew up somewhere else. Many people like me, who have lived overseas for a long time, didn’t realize they had to file taxes because they file where they live. Common sense told them that they didn’t need to pay taxes to a place where they don’t live or receive services.

These Americans also fear that their local banks will find out they’re American. If that happens, the bank, under IGA rules, will send their personal financial information to the US, which could potentially alert the IRS to the fact that they haven’t been filing their forms. This could be disastrous: not in terms of back taxes, but in terms of high punitive fines. The IRS threatens a $10,000 fine for each non-willful violation of a filing requirement. That could add up very quickly. If they determine that it was willful, the fines are even higher. How would they make that determination? I don’t know.

Even Americans who are compliant and up to date on their tax forms fear that the IRS will audit them. Since tax laws are ridiculously complicated for overseas Americans, the chance is high that they’ve made a mistake on their forms, or that their accountants have filled them in wrong.

All of this fear adds up to a strong desire to stay anonymous. Speaking up against the injustice of FATCA, they fear, would “out” them to the IRS. I was surprised at how many messages I received about how “brave” I was when I “came out” against this state of affairs using my full name.

2. Hope

Some overseas Americans are just biding their time, hoping that the new president next year will do something to fix this situation. Interestingly, on the Facebook groups for Americans overseas, opinions vary widely about which candidate is most likely to do that. Many support Trump because of his generally anti-IRS attitude. Many support Sanders because his brother is an overseas American, so they feel he’d understand. Clinton has made vague statements about reviewing the situation.

Some are placing their hopes in Congress: that the next one will hear our complaints about how we are treated under FATCA and make changes. Others hope that either the Rand Paul lawsuit or an ongoing Canadian one will eventually force a change.

3. Indignation fatigue

Another possible reason for the low level of activism is “indignation fatigue” (The phrase is not my invention.). I felt so tired of the fear, anger and resentment that I lost hope and resigned: in other words, I renounced.

People like me who suffer from indignation fatigue feel that nothing will change. Writing letters and articles expressing our indignation accomplishes nothing, making us angrier and more tired.

An example: on the day I renounced, I submitted, with my official paperwork, a written statement explaining my reasons for renouncing. Other than sending me my Certificate of Loss of Nationality, it received no response from the State Department. Afterwards, I sent it in slightly different form to a number of newspapers in the US. Then I submitted it to several different American websites as well. I wanted it to be published somewhere with a much bigger audience of homeland Americans than this blog has so that they could see why the number of renunciations is steadily rising.

Nothing. And I don’t mean it was rejected. I didn’t even get a rejection e-mail from a single one of them. They simply didn’t respond.

Another example: I wrote letters to both the senators in California, where I was registered to vote, as well as to “my” congresswoman. After many months, I received letters back from two of the three, both of them form letters, only one of which actually addressed FATCA. The other was a general “We understand that everyone is concerned about high taxes” form letter: nothing to do with what I had written.

This complete lack of interest on the part of homeland Americans is just so discouraging that we succumb to indignation fatigue and give up.

The future

I sincerely hope that others can use their indignation to summon up the energy to continue the battle. I hope they will contribute to the lawsuits, keep barraging decision-makers with letters, and keep making noise to bring about change by educating homeland Americans about this issue.

Now that I’ve renounced, though, I find that indignation fatigue has taken over, and I need to step back from it and get on with my life as a Dutch citizen. That doesn’t mean I won’t write on FATCA-related topics again; it just means I am turning my attention to other, more positive, things as much as possible.

In the meantime, thank you to those of you who have commented on, shared and otherwise supported my writing on this topic. And I hope you stick around (and subscribe!) to read my travel posts.

Are you an overseas American? Are you still feeling hopeful or has indignation fatigue set in? If you’re a homeland American, did you ever hear of this issue before finding your way to my blog? Feel free to leave a comment below.

My whole US citizenship series:

- Part 1: Giving up US citizenship?

- Part 2: Republicans, expatriates, and FATCA

- Part 3: How my citizenship hit me in the gut

- Part 4: My renunciation day

- Part 5: Thanksgiving reconsidered

- Part 6: FATCA, the Tea Party, and me

- Part 7: Individual freedom, self-reliance and renunciation

- Part 8: Equality? Competition? Not overseas!

- Part 9: The American Dream

- Part 10: The irony of renouncing under duress

- Part 11: Open letter to President Obama in response to the State of the Union Address

- Part 12: 7 Reasons NOT to renounce

- Part 13: Citizenship matters

- Part 14: Citizen of a parallel world

- Part 15: Renunciations in the news

- Part 16: Vote … as a non-citizen? Really?

- Part 17: The ridiculous story of a pilot and his taxes

- Part 18: On receiving my Certificate of Loss of Nationality

- Part 19: So you think you want to emigrate…

- Part 20: Indignation Fatigue and FATCA

- Part 21: The US election, as seen by Americans overseas

- Part 22: On receiving my California voter ballot

- Part 23: Watching America fall apart on my renunciation anniversary

Rachel, thank you. You’re eloquent description sums up what still feels like a scrambled mess for many of us. I’ll keep tuned to your wonderful travel blog as you continue to live your happy and productive life!

Thank you so much! That’s a good way to phrase it: “a scrambled mess.”

Thank you Rachel. This sums it up. I am also renouncing after I did my fifth tax return next year..I will not have any regrets. Proud to be Dutch as well. They have given me so much, opposed to the USA

They have, haven’t they? It’s a good place to be part of!

I’m glad to hear that you’re getting on with your life as a Dutch citizen. It’s really the only thing to do and what I’ve been doing here in Germany since I renounced as well. Regarding the USA, the best policy is “out of sight, out of mind”. My last visit to the USA was 14 years ago and I for one intend to visit Bologna, Groningen and some of those other non-US sights you’ve told us aabout before even considering a trip to the USA ever again. Please keep up the good work you’ve been doing by showing us all the great places to visit here in Europe.

Thanks for the encouragement! I’m not planning a trip to the US again anytime soon either, but I do have some family there, and I do want to visit again. At the very least I’ll go there for my daughter’s graduation when she finishes her Masters in a year or more! She’s in San Francisco and I love that city!

I agree with you that “fear” is the main factor for lack of activism among expats. Many are scared to death from FBAR penalties. In addition to this, many are afraid to go through the renunciation process and therefore trying to stay under the radar until the storm passes, if it ever does.

The FBAR penalties are ridiculous! If I forget to list just one account, I can be fined $5000! And there doesn’t seem to be any limit, i.e. you could actually pile up enough fines to lose all your money. Literally, all of it! I know they mean these fines for wealthy people who are trying to evade taxes, but it’s terrifying for the rest of us.

Before reading your posts, I had never heard of FACTA—and I’m a lawyer in the US! —–a recovering lawyer, but a lawyer none the less. We have a digital nomad son who is talking about opening a non-US bank account. He pays taxes in the US, but I bet he has never heard of FACTA either. Once you renounce your US citizenship, is there a way to regain it without having to go through the same immigration processes that any Dutch citizen does—you know, after Donald Trump is impeached?

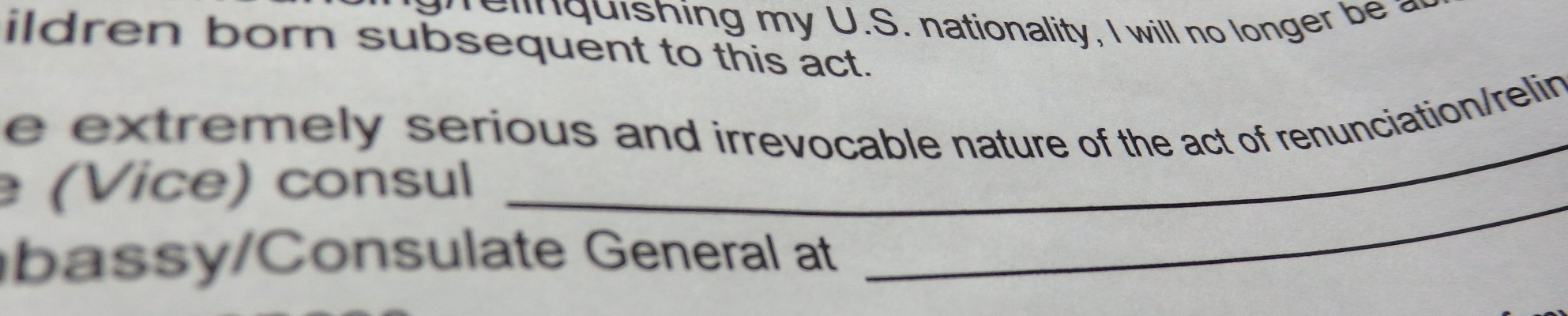

No, there are very clear warnings that the act of renunciation is irrevocable. I had to sign a statement to that effect at the consulate. Some renunciants are hoping that if the court case wins, people who have previously renounced because they were forced to might be able to regain citizenship as part of the settlement. I’m not holding my breath.

The IRS and the United States government is a mess anyhow … despite its apparent superpower status, they are the laughing stock of the first world.

Being a laughing stock doesn’t matter to them at all. Anyway, all the negative stuff about the US still doesn’t make me happy about renouncing. I’ll be glad to be through with the worry, though.

Thanks for introducing me to the term, “Indignation fatigue”which is wonderfully descriptive and can cover a broad range of topics. As Americans we’re taught that our one vote counts, one voice matters and one person can make a difference but obviously, when it comes to raising the issue of FATCA and unfair taxation no one cares … What is so infuriating is the impact FATCA has upon average Americans living overseas while the very rich are shielded still from paying their share. And Trump, the bellicose, bragging, billionaire bully gets away legally with paying ZERO ! OK, I have to admit, I’m not yet fatigued and very indignant!

I’m still indignant too! But I’m trying to distance myself a little bit from everything to do with American politics, including FATCA. Of course, that’s easier said than done, especially given that I’ll be teaching American studies again in the fall, just in time for the elections!

Dear Rachel;

You wanted to make a splash and I can not say if you did or not, but you have touched another human beings heart on this matter and for that I say thank you.

I left the homeland a decade ago, relinquished but do not have a CLN so I live in that proverbial no-mans land of being undocumented. I am afraid of having a back dated CLN turned down along with the expense.

I have followed your story from day one and will refer back to it again many times.

George S.

That means you are stateless, right? That must be tough! I wouldn’t have done this without my Dutch nationality.

Your description of fatigue with indignation will be relevant to many of us though our own stories may differ …

“People like me who suffer from indignation fatigue feel that nothing will change. Writing letters and articles expressing our indignation accomplishes nothing, making us angrier and more tired.”

I may have given up long ago after the huge amount of Canadian dollars I spent in my *official* renunciation of US citizenship in 2012 (though warned in 1975 when I became a Canadian citizen that I would thereby lose my US citizenship) so I could have that CLN to produce for my local Canadian foreign financial institution.

I would never have knowingly subjected my Canadian-born children, born to me, to what has now come to pass. My daughter and I are both on the *name and shame* list though we should certainly would not be considered covered expatriates. My Canadian-born son though, who knows nothing but a Canadian life, cannot renounce because he does not have the requisite mental capacity to understand the concept of *citizenship* and must make that decision with no influence or help from anyone. It is for him and others like him (many more than just those with some developmental disability) who are / will be entrapped, like my son, into costly and complex yearly US tax and account reporting compliance that I continue. My cost, as many, has been much more than the $$$ to come into compliance and go through the expatriation process.

My experience taught me that with the injustice that comes with the very exceptional US citizenship-based taxation, there should only ever be an opt-into US citizenship if the facts permit rather than an opt-out.

That our letters and submissions are summarily dismissed / ignored is good reason for our indignation. It is truly betrayal and makes a sham out of the US claim to be defined as *land of the free*.

Thank you for your strength shown in representation of so many of us in the writings you have produced.

Well said! I feel for you, especially regarding your son being trapped!

https://www.bogleheads.org/wiki/Taxation_as_a_US_person_living_abroad

Thanks Rachel,

There are good business opportunities in Africa, but no one wants to deal with me because of all the laws and Fatca also exposed many potential business partners to unnecessary paper works .

This also created many problems for some elderly foreigners who shared bank accounts with US children. It is a mess.We need to change this law ASAP

I think a lot of people are missing out on business or employment opportunities because of FATCA, but there’s no way to document it.

In this neck of the woods, Belgium, Americans even get to pay more income tax to Belgium than any other nationality on earth. How? Because a bonus is paid via a “SICAV” which is a sort of collective investment scheme. Closed to “US persons”. I’m not American, but became aware of FATCA and the US tax code due to having an American friend. What an absolute horror.

Wow, so you have to give up US citizenship to get your bonus? In some ways that might make the decision easier!