How to handle money in Europe

You arrive at an airport in a foreign city. It’s been a long day: traveling to the airport, waiting in lines to check in and go through security, waiting at the gate for your flight, the hours of the flight itself, and then waiting in more lines on arrival to go through the formalities and pick up your luggage. You’re exhausted. You take some money out of an ATM in the airport, then grab a taxi outside to take you to your hotel.

When you arrive, you shuffle through the pile of bills from the ATM and try to see how much each bill is – it’s dark out by now. You make a futile attempt at figuring out the equivalent in your home currency. You can’t focus, so you take a quick guess and thrust some bills in the taxi driver’s hand. He hands you back some coins. Once you arrive in your hotel room, you collapse into bed and sleep.

In the morning, now that you’ve rested, you come to the awful realization that you paid far too much for that taxi ride. You gave the driver much more than necessary, and, knowing that you were a very tired, newly-arrived tourist, he’d short-changed you – by a lot.

Has this ever happened to you? I’m embarrassed to admit that it’s happened to me at least twice.

As part of the DIY Trip Summit – a virtual travel conference – in early 2026, I led a session called “How to handle money abroad without headaches.” The conference was focused on independent travel within Europe, so I limited my remarks to Europe. This article is the same information, divided into three main topics: cash, cards, and additional suggestions. While I’m looking at Europe here, much of this advice also applies in other countries around the world, but there are exceptions, so always check first!

And it includes some advice about how to avoid that particular situation with the taxi.

Disclosure: This article contains affiliate links. Making a purchase through an affiliate link will mean a small commission for this website. This will not affect your price. Privacy policy.

A note: I’m using the word “dollars” here for ease’s sake, based on the fact that the majority of my readers are in the US. If you’re from somewhere else, just substitute the name of your home currency wherever you read “dollars.” And when I’m talking about currency in Europe, I use the word “euros,” but it could also be, for example, British pounds or Norwegian kroners.

Do you even need cash?

The answer to this question depends on where you are. I live in the Netherlands, and I don’t carry cash with me anymore at all. Instead, I use my debit card for everything. Even in the market buying vegetables, I use a debit card.

However, I can do that because cash is used less in the Netherlands than anywhere else in the EU, followed by Finland and Luxembourg. I managed not to use cash in Switzerland at all when I last visited. However, in many other European countries, including our neighbors in Germany, cash is definitely necessary, so chances are that you’ll need some cash when you travel in Europe.

If your trip in Europe is an all-inclusive tour or a cruise where you’ve prepaid everything, you probably don’t need cash either.

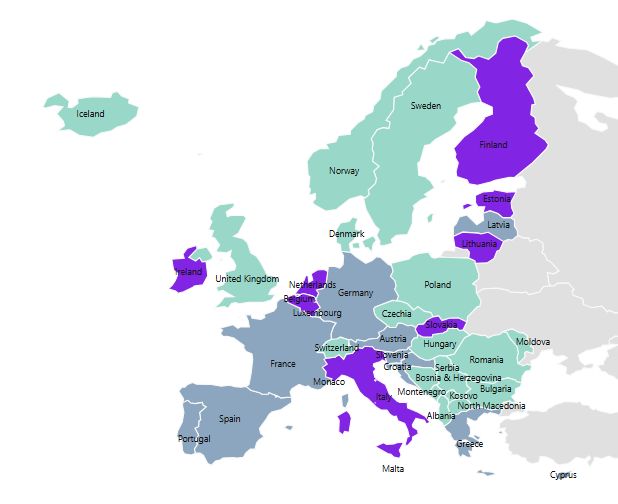

What about the Eurozone?

The map below shows the Eurozone countries in blue, which all use the same currency: euros, whose symbol is €. A euro is made up of 100 eurocents. The coins come in 1, 2, 5, 10, 20 and 50-cent pieces, as well as coins for €1 and €2. They’re all the same on one side, no matter which country they’re from, and they have country-specific images on the other side, but they’re all usable in all of these countries.

1- and 2-eurocent coins

However, the countries in purple on the map below – all Eurozone countries – round off their cash transactions. Businesses in those countries generally won’t accept 1-euro or 2-euro coins. So €1.48 and €1.49 get rounded up to €1.50, while €1.47 and €1.46 get rounded down €1.45. You’re not being ripped off if that happens; it’s perfectly legal. With card payments, they don’t round off.

In any case, it’s useful to know what the 1 and 2-cent coins look like, since they’re easy to confuse. Sometimes, if they’ve accepted any by mistake, merchants might try to pass them on to visiting tourists, so it’s useful to be aware of what they look like, especially if you’re in a country where you won’t be able to spend them.

In the photo above, you can get a sense of their comparative size. The 5-eurocent coin in the middle top is slightly bigger than the US and Canadian pennies. The 2-eurocent size is about the same as the US penny, and the 1-eurocent is slightly smaller.

Where should you get your cash in Europe?

Generally I get cash on arrival in the airport or train station, and after that I only take cash from bank ATMs.

Some people order their foreign currency from their bank at home before they travel. This is not cost-effective. The banks charge a fee for this service, and probably give a poor exchange rate while they’re at it. And it means you carry lots of cash around with you, which isn’t particularly safe.

ATMs

Instead, wait until you arrive. Go to an ATM in the airport or train station when you arrive and take a hundred or two hundred dollars’ worth of cash out. The ATMs in airports generally aren’t great: they charge high fees or don’t give a great exchange rate, but it’s certainly the easiest way to go when you first arrive.

Then, in the first few days of your trip, see how fast that cash goes. Can you use cards a lot or does the cash go quickly? When you have a handle on how much cash you’ll need, take out more from a bank ATM.

Generally, bank ATMs won’t charge as much as free-standing ones in stores or on street corners. Look for a real bank.

Exchange bureaus might say that they charge no exchange fee, but they do: it’s baked into the poor exchange rate you’re getting, so don’t exchange currency there. It’s dangerous to carry too many dollars around anyway.

The same goes for exchange counters in hotels. They generally give poor exchange rates.

Note: If you’re planning to travel outside of Europe, do some research to find out what the situation is where you’re going. In some countries, you shouldn’t use an ATM because the government has set a fixed exchange rate and inflation has moved far beyond that fixed rate. I think that’s true for both Lebanon and Argentina, but it might be true in other places as well. In those countries, you’re actually better off at an exchange bureau than an ATM. Check first!

Three warnings about ATMs

When you use an ATM, keep security in mind just as you would at home. Be aware of your surroundings, have your luggage and handbag between you and the ATM rather than behind you, and don’t let anyone see your pin number when you type it in.

Before you put your card in the card slot, check the slot by grabbing hold of it and trying to give it a shake. It should stay in place. If it wiggles, it may be a fake slot, inserted into the real slot by thieves for the sole purpose of reading card numbers and pin numbers. Find a different ATM and, if possible, report the fake slot.

The ATM should ask you if you want the exchange to be done for you, so the money gets withdrawn from your account in dollars. Don’t do it! You’ll get charged more for the currency exchange than if you leave it in euros and your bank at home does the exchange. And if your home bank overcharges you on the exchange, you’re more likely to be able to get the mistake rectified.

Keeping track of cash

So how do you keep track in a currency you’re not used to? There are three methods I’ve used:

- Figure out an easy conversion in your head. So let’s say €1 = $1.25. That’s easy to figure: every time you see a price in euros, add another quarter of that amount in your head. So €60 euros = 60+15 = $75.

- Find out the conversion equation ahead of time and use your calculator on your phone. Using my example above, I would type in the amount in euros and multiply it by 1.25.

- For the less mathematically-minded, download a currency conversion app to your phone. I use Xe, but there are others. I haven’t checked, but if you use a smartwatch it might have an app to do this. That way, you wouldn’t even need to pull out your phone. You’ll need internet, though, so make sure that’s set up ahead of time too.

Speaking of internet, make sure to check what kinds of charges you can expect if you use your data overseas. It’s likely quite expensive, so think about loading an e-sim onto your phone. I recommend Gigsky because it’s the one I was able to use most easily after first installing it. You buy the number of gigabytes you think you’ll use for the specific country or group of countries where you’ll be. If you end up needing more, you can always add more.

On arrival in the country, activate the e-sim, make sure to turn off your home sim, and set the e-sim as your preferred sim. Otherwise, your home sim will charge you for roaming. Tell your family and friends to reach you via WhatsApp, Signal or similar while you’re on the road, rather than by phone call.

How can I keep my cash safe?

The general problem with cash is that it’s a temptation for thieves and pickpockets, so here are some tips.

Count your change

Unlike me in that taxi, every time you pay something with cash, take the time to be sure you’re handing over the right amount and to count any change you get back. Don’t feel pressured to move away from the cashier or get out of the taxi until you’ve counted it.

Keep cash in a safe place

Keep your cash in a safe place, or preferably divided over several safe places.

I often carry my everyday handbag, but always carry it cross-body. That way it’s harder for passing motorcyclists to snatch it. Some cross-body bags are specifically designed for travel, and are flat enough to be worn under your jacket.

Whatever kind of cross-body bag you carry, make sure to carry it in front whenever you’re around people. In a crowd, keep a hand on it too. There are lots of configurations of this type of bag; take a look at a collection of anti-theft sling bags here.

Many travelers wear a passport pouch around their neck. It hangs in front, and if you tuck it in your waistband, it stays put and isn’t visible. These pouches are small: they hold a passport, some cash, a couple of cards, and that’s about it. Here’s one from Eagle Creek.

If you generally like to wear a belt, you could get a money belt like this Eagle Creek one. These can hold quite a lot of cash, but their disadvantage is that you draw attention to it when you need to pull money out. If you are using one, I’d suggest taking your day’s supply of cash out of it before you leave your hotel room each morning. Put it in your pocket and avoid opening the money belt for the rest of the day.

If you keep money in a wallet, that’s fine, but keep your wallet in your front pocket. That makes it a bit more difficult to pickpocket.

For a little extra security, my husband and I carry “finder cards” by Ekster – we each carry one in our wallets and one in our phone cases. They work like smart tags but they’re rechargeable and the shape of a credit card, only a bit thicker.

Don’t carry a lot of cash.

The more you go to an ATM, the more it’s likely to cost you in withdrawal charges and/or currency exchange. That might lead you to take a larger sum out each time so you don’t have to go as often. Balance that urge to keep costs down against becoming a more likely target of pickpockets, especially if you’re in a very touristy place like Paris, Barcelona or Prague.

Credit and debit cards

Cards are generally safer than cash. Like in the US, there are two kinds you can use in Europe: debit and credit cards. Debit cards take money directly from your balance in your bank account; in the US it’s from your checking account. Credit cards involve borrowing money from the card issuer.

By the way, no one in Europe accepts travelers’ checks anymore. They also won’t accept any sort of personal check, and even the banks won’t cash American checks anymore. Leave the checkbook at home.

Which should you take? Debit or credit?

Take both with you, preferably two of each, so if one doesn’t work or gets lost or stolen, you can use the other. And keep them in two different places. If you’re traveling with a friend or partner, carry each other’s extra cards or, better yet, get them a card for your account.

I speak from experience. Years ago, my husband, our two teenagers, and I took a month-long trip to China. My husband had his wallet in his back pocket, and it must have fallen out on the train on the way from home to the airport. He had time, once he realized it was gone, to run back out of the departure hall at the airport, report the loss to the police and cancel his cards.

Meanwhile, the girls and I sat down to try and figure out how much money we’d need each day – I’d already prepaid all the hotels, transportation and transfers, thank goodness – to see if we could afford to go on this trip without his contributions. We decided that we could, as long as we didn’t go shopping – only food and admissions to sights.

It turned out fine – and we even got to do some shopping – because a) food turned out to be much cheaper than we anticipated; b) I had my own separate debit and credit cards; c) my husband had a money belt with several hundred cash dollars in it; and d) I had a debit card for my husband’s account, which he didn’t cancel when he cancelled his own. However, he had no way to shift any more money into it. I didn’t have much in my account either, but I did have credit.

The story has a happy ending too: someone turned in his wallet and he got it back once we got home.

Debit cards are much more commonly used in Europe. It varies per country, but generally credit cards are not used daily like in the US.

Arrange your credit and debit cards ahead of time

Many cards (debit and credit) are automatically blocked from being used overseas. Check yours. Often it’s something you can set yourself through the bank’s website or app. Otherwise, contact them and ask. When your trip is over, remember to block your cards again!

Another story: On one trip – I think it was Dubai – my debit card wouldn’t work in any ATM I tried – and I tried several! I had a debit card from my husband’s account as a backup, so I called him, told him the situation so he could make sure there was enough in the account, and it was fine. Eventually, I found out that after a certain amount of time, my bank automatically blocks the card from being used in other countries. I should have checked before the trip.

Another thing to check with your bank before your trip is what kinds of fees they charge if you pay things in foreign currency with a credit or debit card or use an ATM overseas. There are cards with no transaction fees, so you might want to get one of those. However, the ATM’s bank will likely charge its own fees that your bank has no control over.

It’s also a good idea to let your bank know where you’ll be and when you’ll be away, so they can help catch any fraudulent charges. You could also set up a daily limit for withdrawals (or raise your usual daily limit). Take their phone number with you – on paper, not in your phone – in case the card and/or your phone gets lost or stolen.

Leave your credit and debit card numbers somewhere at home where you can access them from afar: in the cloud, perhaps, or with a trusted person who you can call. That way, if they’re lost or stolen, you can report them to the bank easily to cancel them. You might be able to report them through a bank app on your phone, if it isn’t also lost or stolen.

Lastly, before your trip, check that you a) have enough money in your debit card accounts and b) have enough credit available on your credit cards.

If this is already seeming like a lot to keep track of, don’t worry! I’ve made a checklist of all the things to set up beforehand and what to do during the trip, plus some other suggestions. Just use the form below to subscribe to my once-a-month newsletter and you can download and/or print the checklist!

Using your debit and credit cards

Visa and Mastercard are most accepted in Europe. They can be used at larger hotels, chain hotels, and large chain stores, but generally not in smaller shops and often not in restaurants either. Some places will only accept one and not the other; they aren’t interchangeable like in the US.

American Express is not accepted in many places: larger hotel chains and chain stores, but that’s about it. Leave any other cards at home.

Make sure you have pin codes for your debit and credit cards, and make sure you remember them! You won’t always have to type a code in, but sometimes you will. A signature isn’t required these days for credit card purchases, which is why knowing your pin number is so important.

Check that your credit and debit cards have either a chip (left-hand picture below), which gets read if you stick the card into their machine, or a tap-to-pay symbol (right-hand picture below), which lets you just hold it near the machine to pay. I’ve heard that tap-to-pay is more secure, i.e. less likely to be hacked. Fewer and fewer venders use swipe machines to read the magnetic strip, so don’t count on that.

Many hotels will ask for a card at check-in, even if you’ve prepaid the room. They put a hold on a certain amount of money – perhaps €100/night – just in case you trash the room or order room service. They release it automatically once you check out. If you use a debit card, that money may be in your account, but it is blocked while you stay there and often for a few days afterwards. So if it’s a long stay – say, a week – you might have $700 that you have no access to for perhaps nine or ten days. Use a credit card instead.

You shouldn’t have to hand debit or credit cards to anyone. Don’t let a salesperson or waiter walk away with your card. Instead, use the card reader yourself. Generally, in a restaurant, they’ll bring it to you, or they’ll ask you to walk to the cash register to pay.

The only place I can think of where you might hand your card over is at a hotel reception so they can take the information for their security hold. Watch what they do with it; generally it involves a scan into their computer, and they should be doing it right there in front of you.

Wise or Revolut

These online banks can come in very handy, I find. I’ve traveled in places outside Europe where my regular bank debit card doesn’t work for whatever reason. Yet my Wise card has worked absolutely everywhere.

Both of these banks are very travel-friendly, and I find their charges very reasonable.

Google wallet or Apple Pay

My Google wallet works easily in pretty much every situation that allows tap-to-pay. I’ve added my debit and credit cards, as well my Wise card. I just swipe to the one I want to use and hold my phone up to the card reader. And paying this way is safer than taking out a wallet and searching for a card.

To open the app requires a pass code or a fingerprint, so set this all up ahead of time.

Don’t rely on this alone, however. Phones do get lost, stolen or broken, so take your physical cards as well. I’d also suggest attaching a lanyard or wristband to your phone and using it consistently to thwart snatch-and-grab thieves.

Banking apps

To keep a handle on your money, download the apps that go with your debit and credit cards so you can shift money around if necessary, block a card that’s been stolen, and so on.

Other advice articles that might be useful to you:

- How to choose a destination: Tips to consider before travel. If you’re like me and want to see everywhere, this guide might help you narrow it down.

- Preparing for a flight: A very complete guide. I wrote this with travelers in mind who are new to flying or haven’t flown in a long time.

- 28 practical tips for women traveling alone. We shouldn’t have to, but women do have to think about safety more than men.

- Minimalist packing tips: How to travel light. On most trips, I take only one carry-on bag and one under-seat bag. This article tells how.

- Solo dining: 16 practical tips for eating out by yourself. Eating out alone is uncomfortable for many people. These tips can help you deal with it.

A few more suggestions

Taking taxis

In many countries in Europe, you can use a taxi service like Uber or Bolt or similar and pay through the app with your credit card so you’re not trying to deal with unfamiliar money as you pay.

Check ahead which services operate in the country you’re visiting, download their app, and set up payments through your credit card in the app ahead of time. You can even pay a tip through the app so you don’t have to deal with cash at all.

As my story about the taxi illustrates, I’ve made the most money mistakes on arrival in an airport in a new country. What works much better, just for that arrival day, is to splurge a bit by booking something like GetTransfer or Welcome Pickups. They meet you at the airport with a sign, walk you to their taxi and take you to your hotel. It’s all paid in advance, so you just don’t have to think about it. If the trip has been long and you’re tired, it makes things so easy.

For less of a splurge on arrival, but still without having to deal with cash when you’re tired, use Uber or similar. Book it after you get through immigration and pick up your luggage. At airports they’re likely to arrive quite quickly.

Book things ahead

I like to book accommodations and transportation ahead of time. The advantage in terms of money is that for me it’s a form of budgeting – it spreads out my payments over the months before the trip. And it means not having to think about paying when you check in to hotels.

Transportation

For trains and buses, Omio works well within Europe, while I’ve found that 12Go works very well in Asia. Or use the particular country’s train app: NS in the Netherlands, DB Navigator in Germany, SBB Mobile in Switzerland (Switzerland has the best trains!), etc. Ferryhopper is useful for booking ferries. And at Discover Cars you can compare prices across different rental car companies.

Accommodations

As for accommodations, I mostly use booking.com just because I like their interface and their many options for filtering. But Expedia and hotels.com work well too. If I’m booking far in advance, I always pay extra for free cancellation.

A tip about booking accommodations: read the reviews! But don’t just read them as given. You can set the order so that you see the most recent reviews first, and that’s key!

A story, again from outside Europe, but it still applies. I had booked a hotel in Delhi for the last few nights of our trip in India. A week or so beforehand, when I got the email notification saying that the refundable payment would soon no longer be refundable, I got back online to booking.com to remind myself what I had booked.

I looked at the reviews, and they were all short and positive. As I read the first several, it dawned on me that these reviews were all very similar, and similarly uninformative. I realized that I hadn’t sorted them. Booking.com sets them automatically to sort by “most relevant,” whatever that means! So I set them to “most recent.” Now the very first review, posted that same morning, said something like “Don’t believe the reviews! They lie! This is a bordello!”

Besides setting the reviews to “most recent,” I don’t even consider any hotels that only have a few reviews. The first few reviews for any hotel are likely to be from friends of the owner, so you can’t trust a hotel’s rating until there are many more.

Should you tip?

Don’t tip like you do in the US! It’s just not necessary in most places in Europe because waiters and porters and such get a living wage in Europe.

High tipping like in the US also spoils things for locals. Service people begin to expect huge tips, and locals may not be able to meet that expectation. And in some places, I’ve heard, tipping is just plain insulting!

Instead, look up what the norm is in the countries you’re visiting. Here in the Netherlands, we generally just leave a euro or two on the table if the service has been good, or tell the waiter a slightly higher total to type into the card reader. For a taxi driver we might round up a bit. But it’s never the 20-25% you pay in the US, so just don’t!

What about leftover cash?

At the end of each trip, there’s always a bit of cash left over. Here’s a fun challenge I like to do while we wait for our flight at the airport. I gather up what’s left of the cash we have – hopefully at this point we only have a few coins in our pockets. The challenge is to spend them down to every last penny. I don’t always succeed, but it’s fun to try finding just the right small item or two – chewing gum or some candy, for example – adding up to exactly what I have.

If that doesn’t appeal to you, there are a couple of other options. If you have a lot left, you can exchange it at an exchange booth at the airport, but the rate they give you will undoubtedly be poor, so I avoid this.

Many airport shops will let you use a combination of your leftover cash and a debit or credit card, so if you want a souvenir, a box of chocolates, or a bottle of alcohol, that works well too.

Of course, you could keep it for the next trip. The question is: is that likely? I have a whole piggybank full of foreign coins, and generally I simply forget to pick through it before a trip.

A free checklist to help you keep track

If you didn’t already, download my free checklist! It’ll help you keep track of all of these things to do before your trip, and give you some additional suggestions and links that might help make your trip go more smoothly.

Fill out the form below to get the checklist. It’ll also subscribe you to my newsletter, but don’t worry! I won’t spam you with mails. All you’ll get is the one single newsletter per month that I send to my subscribers. I will not share your email address with anyone else, and you can always unsubscribe.

I hope this has been of use to you as you plan your trip. And I hope your trip in Europe is everything you want it to be! Please let me know how it goes by adding a comment below!

My travel recommendations

Planning travel

- Skyscanner is where I always start my flight searches.

- Booking.com is the company I use most for finding accommodations. If you prefer, Expedia offers more or less the same.

- Discover Cars offers an easy way to compare prices from all of the major car-rental companies in one place.

- Use Viator or GetYourGuide to find walking tours, day tours, airport pickups, city cards, tickets and whatever else you need at your destination.

- Bookmundi is great when you’re looking for a longer tour of a few days to a few weeks, private or with a group, pretty much anywhere in the world. Lots of different tour companies list their tours here, so you can comparison shop.

- GetTransfer is the place to book your airport-to-hotel transfers (and vice-versa). It’s so reassuring to have this all set up and paid for ahead of time, rather than having to make decisions after a long, tiring flight!

- Buy a GoCity Pass when you’re planning to do a lot of sightseeing on a city trip. It can save you a lot on admissions to museums and other attractions in big cities like New York and Amsterdam.

- Ferryhopper is a convenient way to book ferries ahead of time. They cover ferry bookings in 33 different countries at last count.

Other travel-related items

- It’s really awkward to have to rely on WIFI when you travel overseas. I’ve tried several e-sim cards, and GigSky’s e-sim was the one that was easiest to activate and use. You buy it through their app and activate it when you need it. Use the code RACHEL10 to get a 10% discount!

- Another option I just recently tried for the first time is a portable wifi modem by WifiCandy. It supports up to 8 devices and you just carry it along in your pocket or bag! If you’re traveling with a family or group, it might end up cheaper to use than an e-sim. Use the code RACHELSRUMINATIONS for a 10% discount.

- I’m a fan of SCOTTeVEST’s jackets and vests because when I wear one, I don’t have to carry a handbag. I feel like all my stuff is safer when I travel because it’s in inside pockets close to my body.

- I use ExpressVPN on my phone and laptop when I travel. It keeps me safe from hackers when I use public or hotel wifi.